How Much Is a Gold Bar Worth Today? (2022)

Gold bars are among the most popular vehicles for investing in and buying gold. And as a rare precious metal and volatile commodity, gold changes in value every day.

Curious how much gold bars are worth in 2022? It’s the kind of question that can only be answered when some crucial details are known about a given gold bar. The weight, fineness or purity, and manufacturer are all factors that go into determining the value of a gold bar.

What Is A Gold Bar?

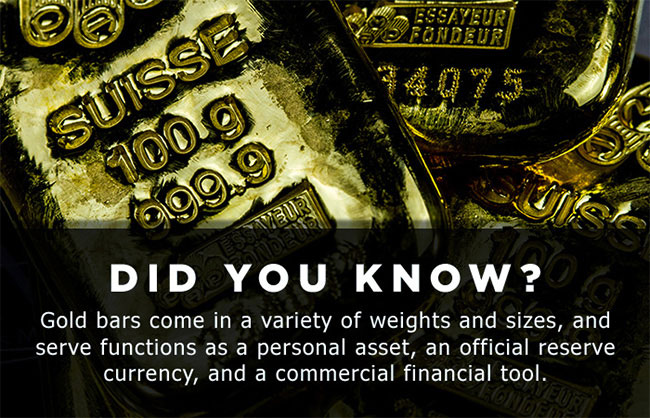

An assortment of gold bars

Before getting into the values of gold bars, let’s first discuss exactly what a gold bar is. They are non-monetized chunks of refined metallic gold. Gold bars may range in physical size and weight anywhere from as little as one gram to as much as a kilo.

It’s also essential to make a sidebar comment here regarding ounces. When speaking of bullion, the term “ounce” or “ounces” virtually always refers to troy ounces, weighing 31.10 grams. This differs from the avoirdupois ounce or “regular ounce,” which comes in at only 28.35 grams.

Another term for a gold bar is ingot. If you see “gold ingots” offered for sale or notice the term used in written or oral communications, it’s a synonymous reference to gold bars. Gold bars, or gold ingots, have been traded for the ages. Often, gold bars were made for transforming newly mined gold ore into convenient and highly liquid stores of gold.

Gold bars are typically stamped with the weight of the bar as measured in grams or troy ounces. Also included is the fineness or purity of the gold and often the name or logo of the assayer or refiner.

While gold is gold, some bullion refineries have earned a reputation for being particularly accurate. They are experts with regards to the weighing of a gold bar’s heft and overall fineness. In measuring gold, absolute accuracy is vital. It can mean the difference of possibly hundreds of dollars or more in the recognized value of a gold bar.

Such reputable refineries have become trusted among investors and collectors. There are many excellent refineries today. Just a few of the most popular in recent times include:

- PAMP Suisse

- The Royal Canadian Mint

- Engelhard

- Sunshine Minting.

Bottom Line:

Gold bars (also called ingots) are refined gold bullion with no legal tender value.

How Much Are Gold Bars Worth?

As mentioned earlier, several factors go into ascertaining the value of a gold bar. Of utmost importance is knowing the weight and fineness of a gold bar. You can go about calculating the intrinsic value of the bar or its spot value based on the day’s current price of gold.

Here at Gainesville Coins, we list the up-to-the-moment gold price per troy ounce. This is one of the most common measurement units for buying, selling, and trading gold. The value of your particular gold bars can be extrapolated from the current gold price per ounce. Simply divide or multiply as necessary to arrive at the weight and fineness of your ingots.

For a year-over-year (YOY) comparison, gold traded around $1,770 on average in 2020. A gold bar was worth in 2020 roughly 25% more than the previous year.

Bear in mind that profit margins in the gold bullion industry are typically very thin. That's particularly true when it comes to trading gold bars. For this reason, many gold dealers and bullion brokers may pay a tiny percentage less than the actual spot price of your gold bar. This is more or less an industry-standard practice. It's how gold dealers are also able to sell you gold bars at or only just above their spot price.

Beyond the price of your gold bar based solely on its spot value, there is sometimes an extra premium assessed for gold bars depending on its refiner. Gold bars that have been refined or manufactured from a lesser-known refinery may not sell for as much as one from a well-known company. This is important to consider when determining what types of gold bars to buy. As with buying appliances, healthcare products, and cars, a brand name can and does matter!

Finally, size matters, too. Gold bars come in a variety of weights. The smaller a gold bar, the higher it's premium relative to its intrinsic spot value. In other words, you’ll pay more, gram for gram, to buy a gold bar that weighs, say, only 1 gram or a half-ounce versus one that weighs one ounce.

Conversely, you’ll pay more, gram for gram, to buy a one-ounce gold bar than you would when buying a bar that weighs a kilo. In this sense, it’s cheaper to purchase larger gold bars than to buy smaller ones with less gold content. However, gold is also expensive. Thus, many refineries and mints offer minted gold bars in smaller physical sizes. This means more individuals can afford to pay the nominal cost of buying gold.

Bottom Line:

Smaller gold bars, and gold bars from name-brand manufacturers, will both have higher premiums.

If you'd like to compare some popular gold bar prices, browse the product listings available at Gainesville Coins below:

Gold Bars As Investments & Collectibles

Gold bars are generally classified as bullion and thus purchased more for speculative motives. A large share of those who buy gold bars are doing so strictly to invest in precious metals. These investors are generally stacking gold as a form of savings. They purchase gold bars based solely on their weight and purity, looking for the lowest premium over the gold spot price.

Most gold bars weigh one troy ounce. Other common sizes are 5 oz, 10 oz gold bars, and 1 kilo gold bars (32.15 troy oz). At the institutional level, you will find the largest gold bars. 100 oz gold bars are used to settle COMEX gold futures contracts in New York, while Good Delivery bars that trade in London weigh 400 troy oz. Kilobars are the standard gold bar size used by the Shanghai Gold Exchange. On occasion, companies like Credit Suisse will also offer 10 gram, 20 gram, 50 gram, and 100 gram gold bars.

There is, however, a segment of the gold bar consumer base that purchases these pieces more as collectibles. This somewhat mirrors the market trends of those who buy bullion-finish American Gold Eagles and gold rounds as collectibles, too.

There are many reasons one might buy gold bars for collectible pursuits. One of the most common reasons is to own an array of gold bars bearing the logos and stamps of various refineries and mints. However, some gold bars manufactured many years ago by private mints are scarce. Many of the gold bars have become collectible on the merits of their real or perceived rarity.

Close-up view of hand-poured PAMP Suisse gold bars

Then there are the gold ingots that were made by popular assayers and refineries during the Gold Rush era in the United States. In the 1820s and ‘30s throughout northern Georgia and western North Carolina, gold was discovered in high volume. The same happened later in the 1840s and ‘50s in California and other western territories. These periods of gold discovery inspired the migration of many thousands of people to these bullion-rich destinations.

Towns sprouted overnight near the mines and rivers where gold was turning up by the literal tons. Assay firms and private mints were also built to help refine and process this newly discovered gold. Some of these assay companies and mints gained solid reputations for correctly measuring and refining gold, and eventually would cast bars or coins for central banks or the United States Mint.

Some of the most collectible gold bars from private and territorial assay and minting companies include those from:

- Blake & Co. of Sacramento California

- Harris, Marchand & Co. of Sacramento and Marysville

- Henry Hentsch of San Francisco

- Justh & Hunter of San Francisco and Marysville

- Kellogg & Humbert of San Francisco

- Moffat & Co. of San Francisco

- F.D. Kohler California State Assayer

Along with producing high-quality gold ingots, many of these firms also struck privately minted gold coins. This includes the Bechtler gold dollars, one of the most well-known souvenirs of the Georgia and North Carolina gold rush days.

You can find out more from our handy Gold Bars infographic.

Bottom Line:

Gold bars minted by name brands, and older gold bars that are no longer in production, may attract a collectible market.

Where to Buy Gold Bars

You should avoid purchasing gold bars from anonymous individuals in peer-to-peer (P2P) transactions unless you have the equipment to verify the metal's authenticity. In these situations, you have to take every precaution against buying counterfeit gold.

Testing equipment or access to a smelter can be very expensive. This is why your best option is to only trust professional gold dealers. You want a seller with legitimate business experience and expertise handling physical gold and silver.

Only on rare occasions will government mints like the Royal Canadian Mint or Perth Mint directly sell their own branded gold bars. Typically these products are only available from authorized distributors.

How Do I Buy Gold Bars?

Once you've chosen a trustworthy bullion broker (precious metals dealer) to purchase from, the process of buying gold bars follows a few simple steps:

- Once you've finalized your order, choose your payment method. This is when you lock in your price.

- Choose between shipping options, local pickup, or vault storage.

- Receive your bullion, or place your investment in your IRA.

For more information, check out our helpful Gold Buyer's Guide.

Bottom Line:

Always buy gold bars from professional gold dealers or, when possible, from government mints.

Joshua McMorrow-Hernandez is a journalist, editor, and blogger who has won multiple awards from the Numismatic Literary Guild. He has also authored numerous books, including works profiling the history of the United States Mint and United States coinage.

More educational resources from Gainesville Coins:

Gold IRA: Invest in Gold Through Your Retirement Account

Gold and Silver Futures Contracts 101

Troy Ounces vs. Ounces: What's the Difference and Why Does It Matter?

product